Business Owners

Strategies to help increase your personal cash flow, keep key employees and protect your business.

Financial Planning

Working closely with clients to achieve their financial goals.

Strategies for Families

Customized solutions based on you, plans for to accumulate and protect your wealth.

Incorporated Professionals

Tailored solutions to help you with your practice and personal cash flow.

Latest News

Optimizing Wealth Through Asset Re-Allocation

If you are an active investor, your investment holdings probably include many different asset classes. For many investors, diversification is a very important part of the wealth accumulation process to help manage risk and reduce volatility. Your investment portfolio might include stocks, bonds, equity funds, real estate and commodities. All these investment assets share a common characteristic – their yield is exposed to tax.

Are You On The Right Track?

In bull markets, some investors develop unhealthy expectations as to the long term yields their investments should provide. Ten years ago, some came to accept returns as high as 15% to 20% per annum as the base return their fund and portfolio managers were expected to provide. Of course, these expectations came crashing back to earth in 2008 as the bull was chased away by a very large bear. Today, many fund managers are of the opinion that double digit returns are going to be very difficult to achieve with any consistency over the long term.

Is it time for us to lower our expectations?

Prepare in Advance for Next Year’s Tax Filing

Was last year’s filing of your income tax return a satisfying experience for you? Did you have a sense of accomplishment or dismay? For many, the April 30th deadline seems to arrive way too soon. If this is the case with you, starting the process much earlier would seem to be the answer.

The process should include proper record keeping, taking advantage of the tax-saving methods available to you, and, perhaps, finally getting a professional to complete and file your return on your behalf.

Basic Planning for Young Families

As a young family, you will be facing a lot of new challenges that you may or may not be prepared for along the way. Whether it’s children, a mortgage, or unexpected expenses that come up, now is the perfect time to start thinking about all the potential pitfalls that may arise.

In this article we want to share some of the ways that insurance can help you stay ahead of these issues, as well as how to prepare yourself for some of life’s obstacles that you and your family may face.

Can Probate be Avoided?

Executors often find that the probate process can be both time-consuming and expensive. Planning strategies exist that may eliminate or reduce the requirement of having assets probated.

Whole Life Insurance – A Whole New Asset Class

The recent developments in investment markets and the volatile performance that has resulted have brought about a new appeal to an old workhorse. For investors looking for a diversification in their investment portfolio and a more tax-efficient fixed income investment alternative, a compelling argument can be made for the use of Whole Life Insurance.

Estate Equalization for Family Business Owners

In the planning of their estates, most parents might prefer to leave their assets in equal shares to their children. Often, the only complication in this scenario could be how to divide up the family home.

For owners of a family business, however, the concept of treating the children equally can often be much more problematic. This can especially be the case where one or more children are active in the business while others are not.

Is the Life Insurance Industry in Canada Stable?

Given the problems encountered by some large financial institutions in the United States, how concerned should we be about the state of the life insurance industry in Canada?

Don’t Wait Too Long to Convert Your Term Insurance

If you require permanent life insurance coverage for family, estate planning, business, or tax planning purposes or you just wish to accumulate money in your life insurance program it may be time to look at a permanent, level-cost solution.

Now May Be a Good Time to Review your Estate Plan

It has long been an accepted strategy to provide sufficient estate liquidity to pay taxes due at death from the proceeds of a life insurance policy. In Canada we are fortunate to have permanent life insurance policies that insure an individual for their entire life with a premium that is guaranteed not to increase. It is feasible to be able to use these policies in an effective estate plan.

Group Life Insurance – Only Part of The Solution

If your goal is to replace income for your family for more than 2 years, you may want to add an individual policy to your group insurance coverage.

According to the same LIMRA study, on average, households with only group coverage can replace the household’s income for less than 2 years. Households with both group and personal life coverage can replace income for more than 5 years.

Is it Time for Your Insurance Audit?

Has it been awhile since you last looked at your insurance portfolio?

Are you a little vague in your recollection of all the coverage you have and why you have it?

Are you uncertain as to whether or not your portfolio reflects your current situation?

Just like going to the dentist for regular checkups is a necessary evil, reviewing your financial plan and products on a regular basis is also recommended. Circumstances can change over time and making sure your protection is keeping pace is a worthwhile exercise.

Estate Planning for Blended Families

In today’s family, it is not unusual for spouses to enter a marriage with children from previous relationships. Parents work hard at getting these children to functionally blend together to create a happy family environment. Often overlooked is what happens on the death of one of the parents. In most cases, special consideration for estate planning is needed to avoid relationship loss and possibly legal action.

Typically spouses leave everything to each other and when the surviving spouse dies, the remainder is divided amongst the children. The problem? Even with the best of intentions, there is no guarantee that the surviving spouse will not remarry and inadvertently disinherit the deceased’s children.

Why you should buy mortgage insurance through your life insurance advisor

Mortgage life insurance from the major banks can be significantly more expensive when compared to life insurance from an insurance advisor. As well, there are additional advantages to buying life insurance through your advisor including the ability to choose your beneficiary, flexibility and more. See our infographic to learn more about the differences between mortgage life insurance through the bank versus your insurance advisor!

Having Your Cake and Eating it Too

Investing in an uncertain stock market is not for the faint of heart. However, fortunately for Canadians, Segregated Fund products offered by many life insurance companies provide a safety net for nervous investors.

Fund products present some interesting opportunities for people looking to get more security in their investment portfolios without sacrificing their potential for growth.

Pay Attention to your Beneficiary

Naming a beneficiary is a valuable feature of life insurance and segregated funds policies so it is important to carefully choose your beneficiaries.

How To Protect Your Estate

You have spent your life working hard and accumulating wealth for you and your family to enjoy. While you are living you pay taxes annually on both your earned and investment income. But did you know that your assets may also result in a tax liability upon your death or the death of your spouse? In Canada, a taxpayer is deemed to dispose of all of his or her assets at death. If the value of these assets exceeds their cost, then, without proper planning, taxes could be payable.

But the good news is, it might be possible to reduce or at least delay the payment of this tax by organizing or re-allocating certain assets that would result in a tax liability at your death. There is also a way to cost-effectively accumulate tax-free funds to pay all or part of any taxes that may become due upon your death.

Of course, every situation is different, so you should consult with a financial advisor before making any big decisions. Below is a simple guide that will help you structure your estate in the most tax-advantageous method.

Have You Overlooked Assets in Your Estate Planning?

Digital assets are essentially anything that has inherent worth that is also in digital form. What establishes their status as an asset is the fact that they come with a “right to use” (e.g. a password). Without a right to use, they are just considered data. Digital assets could include family photos, air miles, hotel rewards, grocery store points, and especially cryptocurrency.

Don’t Qualify For Traditional Life Insurance? Consider These Options

It’s no secret that traditional life insurance, critical illness insurance and disability insurance offer amazing benefits to those who qualify for the policies. Through these plans, people can protect their families, their businesses, and their livelihoods against the unexpected occurring and disrupting their lives. Unfortunately, however, these policies often don’t extend to people who are facing serious health problems and who may need life insurance the most.

Several years ago, two alternative insurance products were offered to help cover people who may have fallen through the cracks when it comes to life insurance. These two new products fall into one of two insurance product categories: guaranteed issue and simplified issue.

All in the Family: Estate Planning for Farmers

Many farmers find it difficult to get any interest from their children in continuing to run the farm business – which can cause some complications when developing the best estate plan for farmers looking to retire.

In general, farmers are in an interesting position: they are asset rich due to the increased value of their land but struggle with the increasing costs related to their farming activities.

However, if the farm holds significant value but the children are not interested in working the land, what is a farmer to do?

Who Should Own My Life Insurance?

The planning considerations of where and how to own your life insurance can be varied and sometimes complicated. It is important to remember that who owns the policy, controls the policy. The owner has the right to name a beneficiary, assign the policy, take cash value loans or even cancel or surrender the policy. The insured does not have to consent to these transactions although there are steps available to require his or her permission when necessary. This article focuses on the main, but not all, issues in determining the ownership of a life insurance policy.

5 Top Financial Planning Strategies For Small Business Owners

Creating a financial plan for your business is critical not only for your business’ survival but also for its growth. However, many small business owners struggle to create a comprehensive financial plan that considers all of the financial needs of the business – which should include long term growth goals and contingency plans for any unexpected circumstances. Below, we have compiled a list of the strategies business owners should start with when considering a comprehensive financial plan.

Impact of Recent Events On Your Estate Plan

A year ago, the projected deficit for 2020 was estimated to be $20 billion. Shockingly, as a result of Covid-19, this projection has risen to over $380 billion by the end of the year. So, what does that mean for tax rates and how will this affect your estate plan?

Government of Canada to allow up to $400 for home office expenses

For the 2020 tax year, the Government of Canada introduced a temporary flat rate method to allow Canadians working from home this year due to Covid-19 to claim expenses of up to $400.

Highlights of the 2020 Federal Fall Economic Statement | Additional $20,000 CEBA loan available now

Finance Minister Chrystia Freeland recently provided the government's fall economic update. It included information on the government's strategy for dealing with the COVID-19 pandemic and its plan to help shape the recovery. We've summarized the highlights for you:

• Corporate Tax Changes, including extensions to subsidy programs.

• Personal Tax Changes, including additional Canada Child Benefit Plan payments and a new "Work from home" tax credit.

• Indirect Tax Changes, including the proposal to charge GST/HST on services provided via digital platforms, as well as the temporary removal of GST/HST on face masks and shields.

For business owners, as of December 4th, the CEBA loan has been expanded by an additional $20,000.

How Many Wills Do I Need?

It is important to have a valid Will to avoid the challenges of intestacy – dying without a Will. Indeed, eventually, everyone ends up with a Will of one sort or other, either the deceased gets to decide how assets are distributed by writing one before death or the provincial authorities get to decide based on intestacy rules. So, it’s always best to get a Will written in advance.

The question is, do you need more than one? Getting one Will is trouble enough, so why would anyone want to have two?

Diversifying in Uncertain Times

Uncertain about where to invest during Covid-19? It may be time to diversify through a Participating Whole Life policy

Preparing Your Heirs for Wealth

If you think your heirs are not quite old enough or prepared enough to discuss the wealth they will inherit on your death, you’re not alone. Unfortunately, this way of thinking can leave your beneficiaries in a decision-making vacuum: an unnecessary predicament which can be avoided by facing your own mortality and creating a plan.

Avoiding the subject of your own mortality can also be an extremely costly to those you leave behind.

How Will COVID-19 Impact the Insurance Industry?

During this stressful and challenging time, many are wondering what effect COVID-19 could have on their life insurance. Some may be worried that the insurance companies would make changes to their existing policy due to coronavirus concerns, resulting in an increase in their premiums or a restriction to their coverage. It should be reassuring to all that insurance companies are generally not able to change the contractual provisions of the insurance policies that are in force.

Canada Emergency Wage Subsidy expanded to include more businesses!

On July 17th, Finance Minister Bill Morneau announced proposed changes to the Canada Emergency Wage Subsidy (CEWS) that will expand the number of businesses that qualify for the program.

Canada Emergency Wage Subsidy extended into December!

On July 13th, Prime Minister Justin Trudeau announced the extension of the Canada Emergency Wage Subsidy (CEWS) until December.

Term Life Insurance – Two Valuable Options

For many Canadians, especially those with young families, term life insurance is most often the product of choice for protecting one’s family. The major reason for this is that it is the lowest entry-level cost to purchase life insurance.

CERB Extended | Business Owners who did not qualify previously – expanded CEBA starts June 19th

Great news for Canadians out of work and looking for work. The CERB will be extended another 8 weeks for a total of up to 24 weeks.

The expanded CEBA will begin June 19th.

Insurance Planning for Business Owners

For business owners, making sure your business is financially protected can be overwhelming. Business owners face a unique set of challenges when it comes to managing risk. Insurance can play an important role.

Small Businesses! Applications for Canada Emergency Commercial Rent Assistance starts May 25th

The Application portal for the Canada Emergency Commercial Rent Assistance (CECRA) opens at 8:00am EST on May 25th

Expanded eligibility for CEBA $40,000 interest-free loan

The Prime Minister outlined the expanded eligibility for the Canada Emergency Business Account and highlighted companies such as hair salon owners, independent gym owners with contracted trainers and local physio businesses will now be eligible.

"If you are the sole owner-operator of a business, if your business relies on contractors, or if you have a family-owned business and you pay employees through dividends, you will now qualify." - PM Justin Trudeau

A Lifetime Gift for Your Grandchildren

If you are a grandparent wishing to provide an asset for your grandchildren without compromising your own financial security you may want to consider an estate planning application known as cascading life insurance.

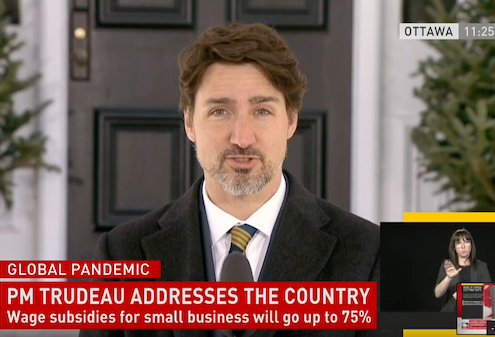

Extended! Canada Emergency Wage Subsidy extended beyond June

On May 8th, Prime Minister Justin Trudeau announced that they will extend the Canada Emergency Wage Subsidy (CEWS) beyond June.

The Estate Bond

Growing your estate without undue market risk and taxes

Often we see older investors shift gears near retirement and beyond. Many become risk-averse and move their assets into fixed income type investments. Unfortunately, this often results in the assets being exposed to higher rates of income tax and lower rates of return – never a good combination.

Or maybe the older investor cannot fully enjoy their retirement years for fear of spending their children’s inheritance.

The Estate Bond financial planning strategy presents a solution to both of these problems.

Apply for Canada Emergency Wage Subsidy starting April 27th | Calculate your subsidy

On April 21st, Prime Minister Justin Trudeau announced that the Canada Revenue Agency will accept applications for the Canada Emergency Wage Subsidy (CEWS) starting Monday, April 27th. This new measure gives qualifying employers up to $847 per employee each week so they can keep people on the payroll.

New Canada Emergency Commercial Rent Assistance | Canada Emergency Business Account Expanded

On April 16th, Prime Minister Justin Trudeau announced support for to help small businesses with their rent for the months of April, May and June.

The program is being worked out with the provinces and more details will be available shortly.

Expanded eligibility for Canada Emergency Response Benefit (CERB) & Boosted wages for Essential Workers

Prime Minister Justin Trudeau announced:

"Today, we're announcing more help for more Canadians. This includes topping up the pay of essential workers. At the same time, we'll also be expanding the Canada Emergency Response Benefit to reach people who are earning some income as well as seasonal workers who are facing no jobs and for those who have run out of EI recently. Expanding the CERB to include people who earn up to $1,000 per month. Maybe you're a volunteer firefighter, or a contractor who can pickup some shifts, or you have a part-time job in a grocery store."

Applications for the Canada Emergency Business Account starts TODAY!

The new Canada Emergency Business Account (CEBA) is available starting TODAY and is available through major banking institutions.

The CEBA will provide qualifying businesses an interest-free loans of up to $40,000 until December 31, 2022.

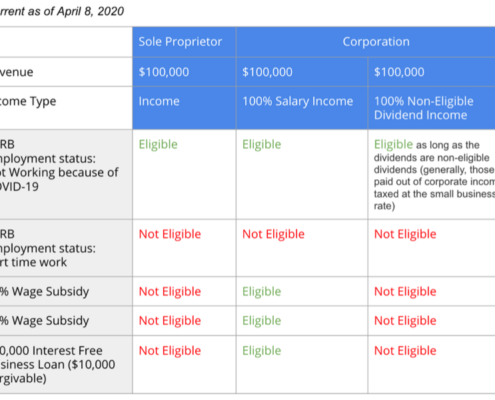

Rules changed to allow more struggling business owners access to CERB, Wage Subsidy. Summer jobs program increased to 100%

A big win today for some small business owners who previously did not qualify for the $500/week Canada Emergency Response Benefit (CERB) or the 75% Canada Emergency Wage Subsidy (CEWS).

Protecting Investments for Your Heirs

Many investors over the age of 60 find themselves in a quandary regarding investments that they intend to leave to their heirs. The primary concern involves the desire to conserve the investments they are bequeathing while at the same time earning a reasonable rate of return. As we all know, the volatility of the equity markets can be cruel and this can be most detrimental when investments do not have time to recover after a downturn. As a result, many mature investors choose to accept low rates of return in order to avoid loss in the funds they wish to leave to family members.

Help for Small/Medium Businesses & Entrepreneurs – 75% wage subsidy, $40,000 interest-free loan & more

March 27, 2019 - Prime Minister Justin Trudeau announced programs and measures focused on helping Small & Medium Sized Businesses and Entrepreneurs cope with the economic consequences caused by the COVID-19 pandemic.

“With these new measures, our hope is that employers being pushed to laying off people due to COVID-19 will think again,” Trudeau said. “And for those of you who have already had to lay off workers, we hope you will re-hire them.”