Basic Planning for Young Families

As a young family, you will be facing a lot of new challenges that you may or may not be prepared for along the way. Whether it’s children, a mortgage, or unexpected expenses that come up, now is the perfect time to start thinking about all the potential pitfalls that may arise.

In this article we want to share some of the ways that insurance can help you stay ahead of these issues, as well as how to prepare yourself for some of life’s obstacles that you and your family may face.

What Issues Should You Worry About the Most?

Now that you’re starting a family, your life is just one piece of the puzzle. Your spouse and any children are also top priorities, meaning that you should consider what could happen to everyone in a variety of scenarios. Here are some crucial questions you and your partner should discuss;

What happens if one of us dies? – While this question may seem a bit morbid, it’s a necessary possibility to plan for, particularly if you are a one-income household. Even with two breadwinners, chances are that your bills and financial responsibilities are too much for one person, meaning that you need to supplement any lost income as a result of one of you passing away.

What happens if one of us becomes disabled? – Disability can cripple a family unit almost as much as death. Not only do you have to worry about losing income because you or your spouse can’t work, but you will likely have mounting medical bills that will exacerbate the situation.

Even if one of you can still work, is the disabled spouse able to care for the children? Will his or her disability impact their ability to do simple tasks, like buying groceries, picking the children up from school or even changing diapers? If the worst should happen, you need to be ready.

How are we saving for future expenses, like college or retirement? – If you’re like most Canadians, you probably worry about having enough money saved for your children’s post-secondary education and your retirement.

As a young family, you may believe that retirement is an event that’s too far off to consider right now, but the fact remains that when you begin saving for retirement will have a significant impact on how comfortable your retirement will be. Sooner rather than later is advisable for both retirement and university savings. Remember, kids grow up fast and you will want to be ready to help them avoid crippling student debt.

How Insurance Can Help

Worrying about the future can be stressful, which is why it’s imperative that you and your spouse put a plan into place. Thankfully, insurance policies can help create peace of mind for both of you, so let’s look at some of the options available;

Life Insurance

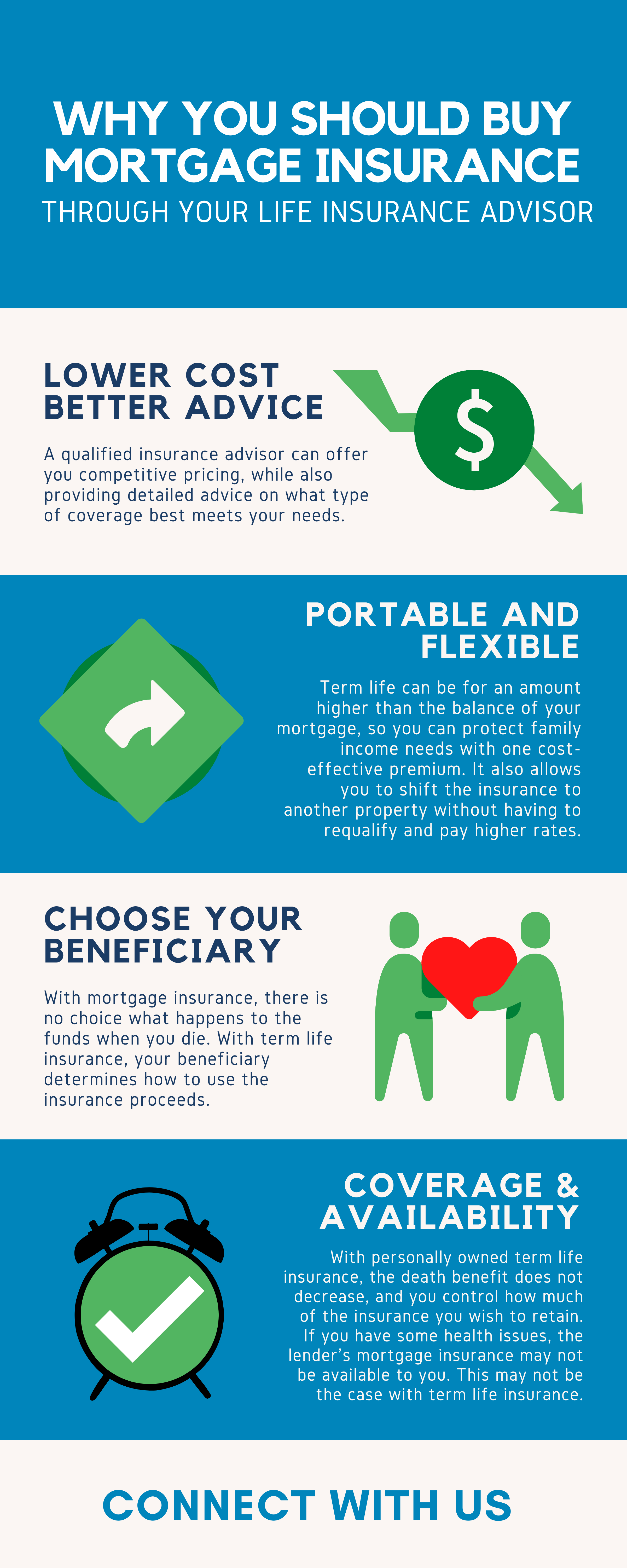

Regardless of your current financial situation, if you or your spouse dies suddenly, it can derail your plans, and it could put your family at risk of accruing debt. When discussing life insurance plans, here are a couple of things to consider;

The Differences Between Term Insurance and Whole Life?

Term Insurance

-

With term life insurance you pay premiums for a specified duration (i.e., 20 years).

-

Your monthly payments are relatively inexpensive.

-

The policy either terminates or renews at a substantial cost at the end of the term period.

-

This kind of policy is excellent if you want peace of mind while the kids are still young

-

Or if you want to avoid high initial premium prices.

Whole Life Insurance

-

Whole life insurance is a permanent plan that can provide protection for as long as you live.

-

Some Whole Life policies become paid up (e.g. 20 pay Life) and stay in force until death or the policy is surrendered.

-

With this type of coverage, you could have a policy on which you have not paid any premiums for decades and when you die your family will receive the death benefit.

-

Another advantage of whole life insurance is that you can contribute money that can also help with retirement. Should you require funds while you are alive, you can borrow against the cash value of your policy or cash surrender the policy in the unlikely event you don’t need it.

Disability Insurance

As we mentioned, a disability can hurt your family as much as a death can. Depending on your employer, you may be eligible for disability insurance through a group plan. One thing that you don’t want to solely rely on, however, is government benefits such as the Canada Pension Plan. Unless you’ve been paying into CPP for many years, your disability benefits most likely would not be enough to cover expenses and lost wages.

Instead, it’s probably best to get an individual disability insurance policy so that you know you’re covered and won’t face any financial shortfalls.

Investing in Your Family’s Future

University education and retirement are two massive expenses for which you should be prepared. Also, if you don’t have a house yet, you should plan on paying a mortgage for up to 30 or 40 years as well. Here are some tips to help you save money for these life events;

Start Early

You may think that saving for these things means that you have to put most of your paycheck away each month. However, even if you save $25 a week, that’s better than nothing. Over time, the money will grow and earn interest, meaning that you can wind up with a significant amount when the time comes.

Open a Registered Educational Savings Plan

When it comes to planning for post-secondary education, an RESP is an excellent way to put aside money for your children. The government will also pay a bonus of up to $500 per year (to a maximum of $7,200) on eligible contributions. There is no annual maximum contribution limit, but the lifetime maximum is $50,000.

Contribute to an RSP (if no company pension plan)

Registered Savings Plans allow you to invest for your retirement and deduct your deposit from your income for income tax purposes. Usually, the maximum allowable contribution is the lesser of 18% of your previous year’s earned income or the maximum contribution amount that changes each year. The maximum contribution for 2023 is $30,780.

Open a Tax-Free Savings Account

Perhaps even before starting an RSP, consider opening a Tax-Free Savings Account.

-

An individual aged 18 and older may contribute up to $6,500 to a TFSA. This can be done every year with the maximum limit adjusted for inflation and rounded out to the nearest $500.

-

Funds contributed to a TFSA are not tax-deductible, but the growth and any withdrawals are tax-free.

-

If you have not contributed to a TFSA, you have been accumulating deposit room for the years you did not contribute. As of 2023, that deposit room has increased to $88,000.

There is an old saying, that people don’t plan to fail, they fail to plan. The sooner you start that planning the more effective it will be.

As always, please feel free to share this information with anyone you think would find it of interest.